Beauty empires collide.

Revlon, Inc. and Elizabeth Arden, Inc. announced that they have signed a definitive agreement under which Revlon will acquire all of the outstanding shares of Elizabeth Arden for $14.00 per share in cash, representing an enterprise value for Elizabeth Arden of approximately $870 million.

The official release states: By bringing together two highly complementary, iconic brand portfolios, Revlon will benefit from greater scale, an expanded global footprint, and a significant presence across all major beauty channels and categories, including the addition of Elizabeth Arden’s growing prestige skin care, color cosmetics and fragrances.

The combination will leverage Revlon’s scale across major vendors and manufacturing partners, improving distribution and procurement. Cost synergies of approximately $140 million are expected to be achieved through the elimination of duplicative activities, leveraging purchasing scale, and optimizing the manufacturing and distribution networks of the combined company. The companies anticipate that they will achieve additional growth opportunities in both sales channels and geographies.

Fabian Garcia, President and Chief Executive Officer of Revlon, Inc., said, “This acquisition is strategically and financially compelling. Elizabeth Arden and Revlon are both known for their iconic brands, entrepreneurial spirit and commitment to innovation, quality and excellence. Revlon plans to build upon Elizabeth Arden’s ongoing transformation by further enhancing the brand, with even more vibrant and relevant product development and marketing, while carefully preserving its unique heritage within prestige. Combining our brands, talent, and global distribution will give our company a significant presence in all major channels and categories, while accelerating sales growth in existing and new geographic regions. We look forward to bringing together our two top-notch teams to form a global leader in beauty.”

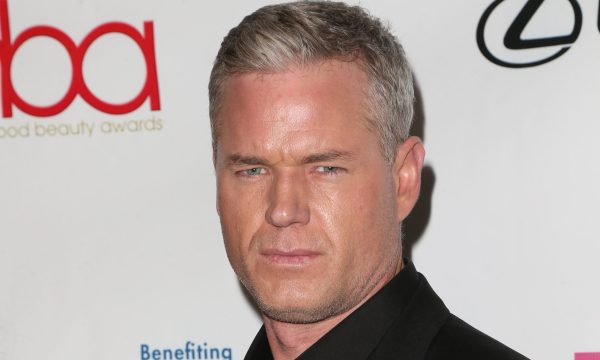

E. Scott Beattie, Chairman, President and Chief Executive Officer of Elizabeth Arden, added, “We believe this is a compelling transaction that delivers certain value to our shareholders, while recognizing the unique equity in the Elizabeth Arden brand, our impressive fragrance portfolio and global footprint, as well as the positive momentum and growth potential for our business. We look forward to working with the Revlon leadership team to create a leading global beauty company, able to provide accelerated growth for the Elizabeth Arden-branded products as well as our prestige licensed fragrance portfolio, and broader opportunities for many of our employees.”

• Expanded Category Mix: Revlon’s strength and expertise in color cosmetics, hair care, men’s grooming, antiperspirants, deodorants and beauty tools will be complemented by the addition of Elizabeth Arden’s world-class portfolio of licensed prestige fragrances and the internationally recognized line of Elizabeth Arden-branded prestige skin care, color cosmetics and fragrance products, highly profitable categories that are key to future industry growth.

• Channel Diversification: Elizabeth Arden’s strong global reach in prestige distribution and travel retail will complement Revlon’s strength in mass and salons, strongly positioning the combined company in all key beauty channels.

• Broader Geographic Footprint: Revlon currently sells its products in approximately 130 countries. With Elizabeth Arden’s presence in