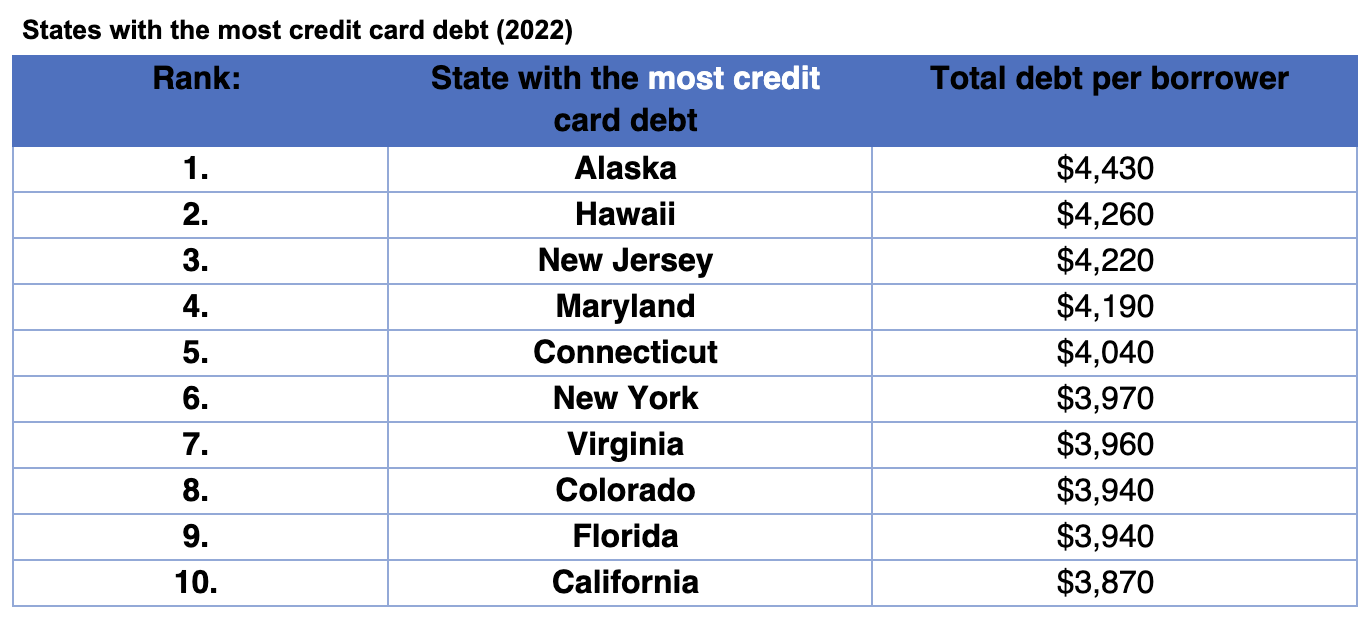

A new study reveals that Alaska is the state with the most credit card debt. California ranks tenth with an average of $3,870 per borrower.

Money experts Moneywise analyzed household debt statistics released in May 2023 by the Federal Reserve Bank of New York to reveal which states have the highest amount of credit card debt per borrower.

The study revealed that Alaska is the top state with the most credit card debt. As of December 2022, each borrower in Alaska has an average of $4,430 in credit card debt, which is 9% higher than the previous year. Statewide, the current average total debt for borrowers in Alaska is $67,670, which includes an average of any student loan, auto, credit card and mortgage debt altogether.

Hawaii ranked next, as the second state with the largest amount of credit card debt per borrower. The state has an average of $4,260 in credit card debt, a staggering 14% increase compared to the previous year. The study also uncovered that out of all states, Hawaii ranks as the third state with the most total debt per borrower, averaging out to $82,650.

New Jersey ranks third with the most credit card debt per borrower, averaging $4,220, 14% higher than the previous year. The state has an average of $66,800 in total debt per borrower.

Maryland ranks fourth, with an average of $4,190 in credit card debt per borrower and is followed by Connecticut which has an average of $4,040 per borrower. The top 10 is rounded out with New York ranking sixth, Virginia ranking seventh, and then Colorado, Florida and California ranking eight, ninth and tenth, respectively.

“The average amount of debt per person has slowly crept up year by year, and this cycle will continue as prices for everyday goods simultaneously increase too. According to the Consumer Financial Protection Bureau, Americans pay nearly $120 billion in credit card fees and interest a year,” A spokesperson for Moneywise said.

“Unfortunately, credit card debt has become a norm as people need to borrow money for day-to-day spending. The most common expenses on credit cards are for unexpected emergencies, medical bills and groceries. The main culprit for total debt for Americans is mortgages, exceeding other types of debts by a wide margin, followed by student loan debt.

“The data highlights how important money management is for everyone. That includes everything from keeping track of your expenses and the debt you take on, to the choices you make about the future such as investing. Interest has never been higher among the public regarding how to make money from the stock market, so it’s vital to be well informed about the best ways to approach such investment opportunities,” they added.